Background

The new Social Insurance Law (effective as of 1 July 2011) requires non-Chinese national employees to participate in China’s social insurance system, placing costs on the employee and the employer. The “Interim Measures for Participation in Social Insurance by Foreigners Employed in China” (effective 10 October 2011) provides additional details.

Definition, Registration

The new measures apply the contribution schemes of Chinese national employees to non-Chinese national employees working in China. A non-Chinese national employee working in China is defined as a non-Chinese national who has a valid employment permit to work in China for a China-based employer (a “Foreign Employee”). Employers are required to register for a Foreign Employee’s social insurance within thirty days of applying for their employment permit.

Contributions

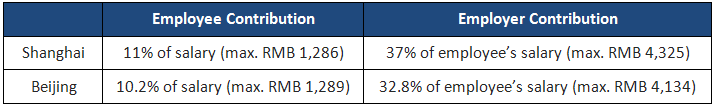

Both the employer and the Foreign Employee must make social insurance contributions based on the employee’s salary.

As is the case for Chinese national employees, we can expect the social insurance contribution rates for Foreign Employees to vary depending on the region of the Employer. For illustration, the below chart compares the required contributions of an employee and his or her employer in Shanghai and Beijing respectively:

Penalties for Failure to Register or Contribute

If an employer fails to register for a Foreign Employee’s social insurance or fails to make the prescribed social insurance contributions, the employer may face penalties of up to three times the overdue amount. A Foreign Employee may also request that non-payment be addressed by social insurance authorities, which may even give rise to a private cause of action against the employer.

Social Insurance Coverage

Foreign Employees have coverage for maternity, unemployment, pension, work-related injuries, and medical care. Specific details of coverage are complex and can be obtained by consulting the relevant measures and local bureau.

Exemptions

Foreign Employees from countries that have entered into totalization agreements with China are exempt from participating in the Chinese social insurance system; as of the date of this CS Alert, only Germany and South Korea have entered into such agreements with China. It is probable that other countries will seek to enter into totalization agreements with China as a result of the new Social Insurance Law.

Ambiguities

Many questions regarding the new social insurance contribution system for Foreign Employees remain, including the following:

(i) Implementation of social insurance for Foreign Employees will occur at the local level. The extent of the variance in contribution rates, administrative procedures and social insurance issuance are yet to be published.

(ii) Foreign Employees and their employers may be required to make retroactive social insurance contributions that date back to either July or October of 2011.

(iii) A Foreign Employee may withdraw his pension upon leaving China, but it is unclear how the employee may do so or whether the pension will be taxed.

(iv) The pension amount may be inherited by the Foreign Employee’s estate. However, details, including procedures to specify a recipient, are not readily available.

(v) It is unclear how a Foreign Employee will receive unemployment insurance payments if she loses her job and thus loses the employment permit that allows her to legally reside in China.

(vi) Medical insurance can only be used at government-approved hospitals which currently do not include international sections of domestic hospitals or international clinics that are preferred by Foreign Employees.

(vii) It is unclear whether a pregnant Foreign Employee will be subject to the one-child maternity insurance coverage policies that apply to Chinese nationals.

Implications for Companies Employing Foreign Employees

Employers of Foreign Employees must remain aware of ongoing developments in the social insurance system. Fiscally responsible employers should budget for increasing costs of employing Foreign Employees and potential requirements for retroactive social insurance contributions.

©2012 All content of this article is the property and copyright of China Solutions Inc and may not be reproduced in any format without prior express written permission. The content of this article is intended to provide a general guide to the subject matter and should not be treated as a substitute for specific advice concerning individual situations. Readers should seek legal advice before taking any action with respect to the matters discussed herein.

To subscribe to CS Alerts, click here.